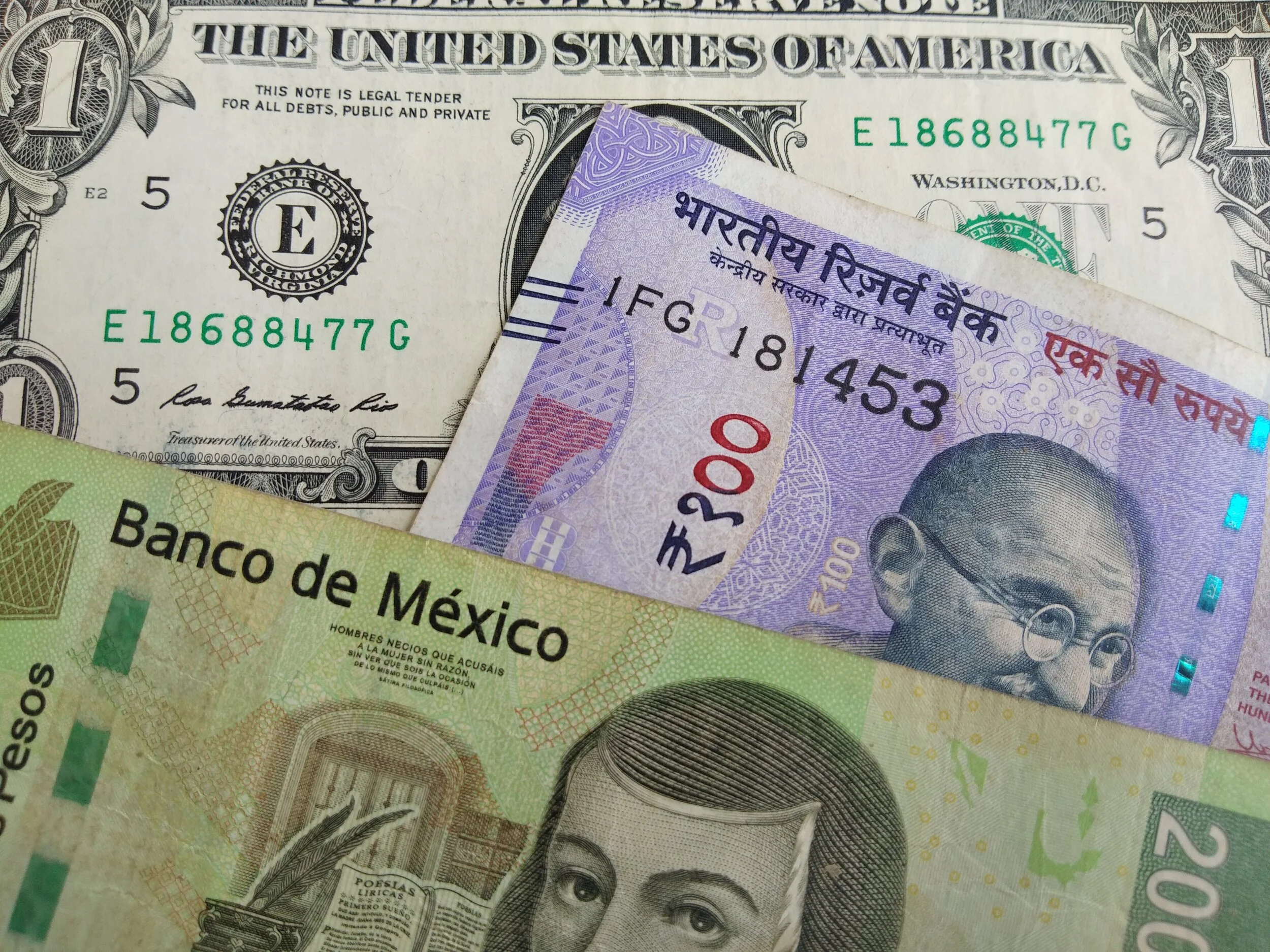

Tools Forex Investors Should Know About

/The forex market is a vast and lucrative entity, and one that sees an estimated $6.6 trillion traded globally every single day.

This number continues to rise incrementally over time, as the market becomes increasingly accessible to part-time traders and continues to provide a clear incentive to those who want to make currency trading their business.

The market is volatile and margin-based, however, which means investors can lose considerably more than their initial commitment in some cases. So, what tools can traders use to improve their skills and optimise their chances of securing a profit in the market?

Online Brokerage Sites

As a new trader, it’s imperative you look to optimise your access to the financial markets and the analytical tools that can empower you to make informed decisions.

To this end, you’ll need to channel your trades through an online brokerage site, which can also connect you to accessible and mobile trading apps such as the MetaTrader 4 (MT4) which enables you to execute informed orders in real-time, without compromising on the data needed for a successful trade.

Interestingly, online platforms of this nature can also connect you to a so-called ‘demo account’, which essentially simulates a real-time market in which you can test and hone your trading strategies over a period of time. This can bridge the gap between theoretical knowledge and practical experience, making you competitive when you enter the market for real.

The Economic Calendar and More

Interestingly, these apps are also home to tools that can enable you to become a more successful trader in practical terms. Take the economic calendar, for example, which is a key feature of most brokerage sites and offers direct access to key data releases and events from across the globe.

Given the relationship that exists between macroeconomic factors and the value of currency, these events can be used to inform your decisions and time specific trades with a view to optimising profitability.

From a risk-management perspective, you can also use stop-losses to safeguard your hard-earned capital. They will automatically close positions once they’ve incurred a predetermined level of loss, preventing large-scale losses that are disproportionate to your initial investment. These tools can help you make incremental improvements and become more successful over time, especially when they’re combined with a host of simple steps you can take in the quest to become more profitable.

Keeping a record of your profits and losses can be particularly informative, for example, especially as you look to learn from previous mistakes and streamline your efforts going forward.

Selling online is about making sure orders reach customers quickly and hassle-free. If a package arrives late, damaged, or not at all, customers won’t just be annoyed…they might never shop with that business again. On the flip side, smooth and reliable deliveries make people happy, build trust, and keep them coming back for more.